Did you know that accounting software solutions have a significant positive relationship with business performance among small and medium enterprises (SMEs)? Accounting software for small businesses improves performance in different ways, from impacting business operations and financial reporting to overall growth.

But with so many options available, where do you start?

In this article, we’ll explore the debate between standalone accounting systems such as Quickbooks, Zoho, and Intuit and ERP-based solutions like Odoo, Netsuite, and Xero.

Whether you’re a boutique store owner or an e-commerce entrepreneur, understanding the pros and cons of each approach is essential.

Let’s explore the problems faced by small retailers and how the right software can alleviate them.

The Common Issues in Small Retail Business

You're in the right place if you feel that your retail business needs improvement in some of these aspects:

- Time-consuming manual processes: Small retailers often find themselves drowning in paperwork - manually recording sales, purchases, and inventory. This inefficiency can lead to errors, delayed financial reporting, and missed opportunities.

- Lack of real-time insights: Waiting for month-end reports to understand your financial health is like driving blindfolded. Retailers need timely insights to make informed decisions, especially when dealing with inventory management, pricing, and cash flow.

- Scalability challenges: As your business grows, so does the complexity of your financial transactions. A system that can’t scale with your business can hinder expansion and cause headaches down the road.

- Integration hassles: Aside from needing double-entry accounting, retailers often use multiple tools—point-of-sale (POS) systems, inventory management, e-commerce platforms, etc. Sometimes, even payroll software. Integrating these seamlessly is critical for accurate financial data.

- Data security concerns: Protecting sensitive customer information, financial records, and transaction details is paramount. A breach can damage your reputation and lead to legal consequences.

If you experienced one or more of these problems above, then you're in for a treat. Let's explore the two main contenders: standalone accounting software and ERP solutions. Which one aligns better with your retail business needs? Let’s find out!

Key Factors for Choosing the Right Accounting Software

Selecting the best accounting software for your small retail business is akin to choosing the right foundation for a sturdy house. It’s not just about features; it’s about aligning the software with your unique needs and business context.

Let’s break down the key factors to consider:

1. Business Size

When considering the business size for selecting the best accounting software for small retail businesses, it’s essential to understand that the needs of a micro-business will differ vastly from those of a small to medium-sized enterprise.

Micro-business (1-10 Employees)

For micro-businesses, often operating with a lean staff and limited resources, the focus should be on finding a solution that can grow with the business without requiring a significant investment in IT infrastructure.

In this case, finding stand-alone accounting software that’s not only cost-effective but also easy to use will be ideal for your retail. Some might argue that utilizing the best free accounting software would suffice for micro-business owners.

However, the caveat is that it might be difficult to find free software that offers essential features like invoicing, expense tracking, and basic inventory management, which are crucial for day-to-day operations.

Small Business (11-50 Employees)

On the other hand, small businesses face the challenge of balancing growth with operational efficiency. They need to consider an accounting solution that can handle an increasing number of transactions without compromising performance.

This is where ERP can play a big role as a small-business accounting software.

Although the software product may require a more significant upfront investment, the integration capabilities and advanced reporting features can provide a comprehensive view of the business’s financial health.

This is particularly important for retail bookkeeping, where managing inventory and sales tax compliance are common problems.

2. Transaction Volume

As retailers, you might notice that your volume of transactions directly impacts your accounting workload.

If your business deals with a low transaction volume, you’re likely juggling fewer invoices, receipts, and financial entries. However, even in this scenario, manual data entry can become overwhelming. Imagine spending hours inputting sales data, reconciling bank statements, and categorizing expenses.

Rest assured that the time-consuming manual process leaves room for errors.

To address this, consider standalone software with automation features. Look for batch processing, automated bank reconciliation, and streamlined categorization. By automating routine tasks, you free up valuable time and reduce the risk of mistakes.

On the other hand, if your business experiences a high transaction volume, the challenges intensify.

Picture a bustling retail store with numerous daily sales, inventory movements, and supplier invoices. Handling all this manually is like trying to catch a waterfall with a bucket.

The problem now is dealing with time-consuming data input and reconciliation.

Here, ERP (Enterprise Resource Planning) systems shine as retail accounting software that is better suited to handle large volumes seamlessly and integrate with other third-party systems or modules while possessing all the automation features and more.

However, be prepared for a more significant upfront investment and potentially complex implementation. The payoff lies in efficiency gains, reduced errors, and scalability.

3. IT Expertise

Consider your team’s technical proficiency and pick the difficulty you’d like to address first.

User-Friendly Interfaces: One common issue faced by staff is struggling with some complex small business accounting software. You can address this by prioritizing intuitive interfaces when choosing accounting software.

But, you’d want to consider training time as a critical factor. In that matter, standalone software often excels in this category, as it allows teams to quickly adapt without extensive training.

ERP Complexity: To install the best retail accounting software in ERP systems is inherently complex and demands expertise. Engage IT professionals or invest in training to navigate this complexity effectively.

Side note: ERP experts can adjust to your needs whether you are interested in cloud-based accounting software, host it on your on-site server (you can treat it as desktop software), or hybrid. While standalone software typically only provides cloud accounting. But don't fret; most people have an internet connection, so you’ll still be able to do your work with you. It would work wonders if you do not have on-site IT specialists.

The payoff lies in comprehensive functionality and streamlined processes. Remember that the initial complexity pays off when your team can efficiently manage inventory, track sales, and generate accurate financial reports.

4. Bookkeeping Integration

When it comes to bookkeeping, an ERP system integrates various accounting tools as the core of operations, where bookkeeping is automatically generated from daily activities across various modules.

The workflow of the accounting app creates a seamless data flow, with financial entries recorded directly into the General Ledger (GL), providing end-to-end financial transparency.

For example, when a sale is made, the ERP system not only processes the transaction but also updates inventory valuation and the cost of goods sold in real-time, ensuring that financial statements are always current.

In contrast, standalone software operates independently of other business processes.

While its accounting features can manage financial transactions effectively, it lacks the ability to automatically integrate data from sales, inventory, or purchasing.

This means that in markets like Vietnam, where businesses often require a centralized system for efficiency, standalone software falls short. It cannot provide the interconnected bookkeeping that an ERP system offers, which is essential for generating comprehensive financial statements and management reports.

5. Budget

For business owners, financial constraints shape their accounting solution options. Let’s consider the budget aspect:

Standalone Accounting Software Costs

If your budget is tight, explore free standalone options. These basic tools can serve small businesses with straightforward needs.

For example, QuickBooks Online, a popular choice for online retailers, offers plans starting at $30 per month. This software can integrate with platforms like Shopify and Amazon, supporting over 150 currencies, which is ideal for retailers selling globally.

However, be cautious of hidden costs—upgrades, customer support fees, and limitations. While they alleviate immediate financial

ERP-Based Accounting Software Costs

Sometimes, ERP systems require substantial investment, including licensing, implementation, and training.

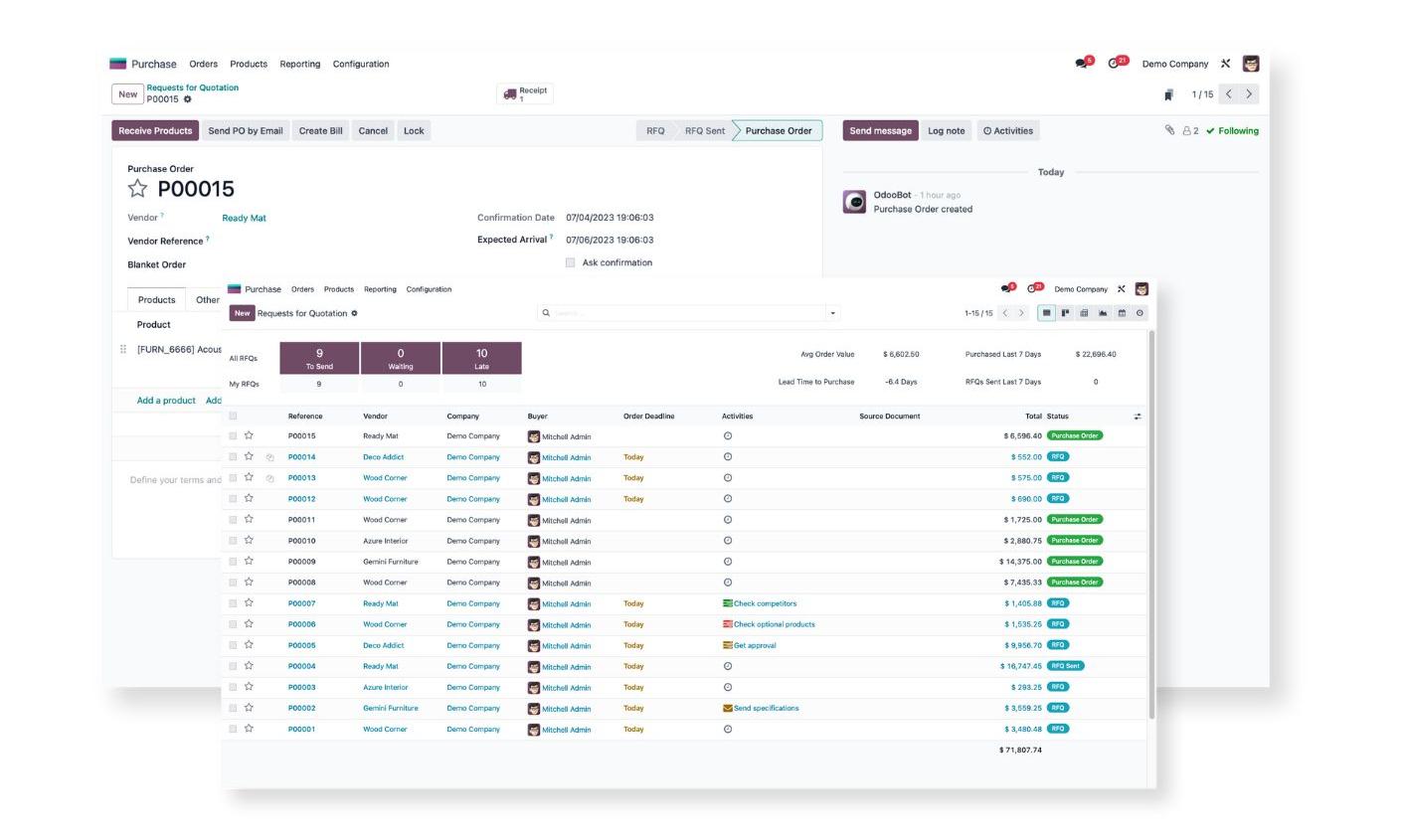

For instance, Odoo ERP offers a more comprehensive solution, with prices starting at $10.90/user/month. While it could be more costly when used by many users, it provides extensive features tailored for medium to large businesses, such as omnichannel capabilities and in-store mobile POS systems.

The price could increase by much if you use an ERP like Netsuite, which has a starting cost of $99.00/user/month.

Additional Cost-Benefit Analysis

To conduct your first cost-benefit analysis, let’s consider a hypothetical medium-sized retailer with both online and physical stores:

- Operational Costs: Retailers that choose to implement ERP systems may require additional investment in training and support, while standalone systems are typically easier to implement and maintain.

- ROI: ERP systems like Odoo offer real-time data across all marketplaces, which can lead to better-informed decisions, increased sales, and customer retention. Standalone systems may lack this level of integration but are sufficient for smaller retail operations.

You’ll find that this principle applies to more than just accounting software. The concept was discussed in our CEO’s newsletter, which discusses Enhancing Operational Efficiency with HR Modules for Higher Profitability (and Sustainability

¿Está listo para encontrar el mejor software de contabilidad para pequeñas empresas minoristas?

Podemos ayudarlo con sus problemas de contabilidad.

Exploring Standalone Accounting Software

So, at this point, you might wonder, “We know a lot about what ERP does and how it benefits our accounting processes in invoicing and bookkeeping. But what is this standalone accounting software we’ve been reading about?”

You might have the correct idea that it is a pivotal tool for small retail businesses seeking financial clarity and control.

Standalone systems are designed to cater specifically to accounting functions, offering dedicated modules that streamline financial operations without the complexity of broader ERP solutions.

Now, unlike ERP systems that encompass a wide range of business processes, standalone software hones in on accounting, offering software for retail shops that need robust yet straightforward financial tools.

Key Features of Standalone Accounting Software:

- General Ledger: The heart of any accounting system, the general ledger is where all financial transactions are recorded. It’s the central repository that reflects the financial health of your business, making it a critical feature for retail bookkeeping.

- Accounts Receivable: This module tracks money owed to your business by customers. It’s essential for managing cash flow and ensuring that sales translate into actual revenue, a key concern for accounting software for online retailers.

- Accounts Payable: Conversely, this module manages money your business owes to suppliers. Timely and accurate payable management is crucial for maintaining good relationships with vendors and avoiding costly late fees.

- Invoicing: Generating invoices to customers and vendors is a daily task for retail businesses. Standalone software often includes customizable invoicing features, making it easier to bill customers and manage sales transactions, a boon for software for retail.

- Reporting: Insightful financial reports are invaluable. Standalone systems provide a range of reporting options, from profit and loss statements to balance sheets, giving you the actionable insights needed for strategic decision-making.

Pros and Cons of ERP Systems and Standalone Software

In sum, this table can provide you with a quick reference to help you weigh the advantages and disadvantages of each system type.

When making your decision, consider how these factors align with your retail’s current needs and future goals. The right choice will depend on a variety of considerations, such as:

1. Customization

ERP Systems | Standalone Software |

Pros: Highly customizable to fit complex business processes. | Pros: They are easy to set up and use, often with intuitive interfaces designed for basic accounting needs. |

| Cons: Can be costly and time-consuming to customize. | Cons: They can't adapt to specific business needs or integrate with other software you use |

2. Data Centralization

ERP Systems | Standalone Software |

Pros: Centralizes all business data, providing a single source of truth. | Pros: Focuses on financial data centralization, which simplifies accounting tasks. |

| Cons: May require significant changes to existing business processes. | Cons: Does not centralize non-financial business data. |

3. User Training

ERP Systems | Standalone Software |

Pros: With comprehensive training, skilled users capable of leveraging the system’s full potential. | Pros: Easier to learn due to focused functionality, leading to quicker adoption. |

| Cons: The system constraints and logic results in more complicated in-user operations and behavior in the system. It requires a significant investment in ongoing training. | Cons: Users may need additional tools and training for non-accounting tasks. |

4. Support and Maintenance

ERP Systems | Standalone Software |

Pros: Often includes professional support and maintenance services. | Pros: Simpler systems can be easier and less costly to maintain. |

| Cons: Support and maintenance can be expensive over the long term. | Cons: May lack comprehensive support services offered by ERP providers. |

5. Scalability

ERP Systems | Standalone Software |

Pros: Designed to scale with the growth of the business. | Pros: Can be suitable for businesses with a stable size and transaction volume. |

| Cons: Scaling up may require additional modules and costs. | Cons: May require migration to a more robust system as the business grows. |

6. Compliance

ERP Systems | Standalone Software |

Pros: Better equipped to handle complex compliance requirements. | Pros: Simplifies compliance for core accounting regulations. |

| Cons: Compliance features may add to the complexity and cost. | Cons: May not cover all compliance aspects beyond accounting. |

Hybrid Approach: Bad Idea

If you're thinking of having the best of both worlds by using a hybrid approach - connecting a stand-alone with ERP: Forget it.

It's a bad idea.

Here are the reasons why:

- ERP should be the central accounting system within a business because it integrates core finance with other operational software that lacks financial capabilities.

- If you need a comprehensive, real-time view of financial data, you are looking for an ERP. Using two software will result in data mismatches and less reliable information for business decision-making.

- Using different software will lead to inconsistencies. Each has a different bookkeeping logic that would muddle your real data.

- Replicating accounting data from ERP to standalone software or vice versa is not ideal. There is a huge risk of errors that can affect data integrity. It also comes with unnecessary complexity and inefficiency, not to mention the additional costs that may incurred.

Then again, why would anyone install separate software when they can do it all in one?

Why a Unified ERP Approach is Often Best?

For retailers, the strength of an ERP system lies in its comprehensive financial management capabilities.

ERP integrates core financial operations with other business software that may lack inherent financial capabilities. It’s essential to harness the full potential of the ERP’s accounting module rather than relegating bookkeeping tasks to standalone software.

All-in-one Capability

It’s like having a financial dashboard that tracks every transaction, from a customer’s order to the final payment. This system keeps tabs on sales, stock values, costs of goods sold, discounts, and payments—all in one place.

It simplifies the complex dance of numbers, giving you a clear view of your retail’s financial health without the need to switch between different software.

Product Journey Tracking

An ERP goes beyond just sales; the system manages the entire journey of your products.

From the moment you purchase items for your inventory to the time they’re sold, every cost is accounted for. This detailed tracking helps you understand the true cost of each product, considering all associated expenses.

Plus, ERPs have ‘mediate accounts,’ which act like flexible connectors in your financial system, allowing you to adjust and adapt without a hitch.

Automated Bookkeeping

ERPs handle the heavy lifting of bookkeeping automatically. They generate consistent financial records based on your daily operations, from inventory changes to customer and vendor transactions.

You’ll only need to step in for manual bookkeeping in special cases, like adjustments or unique situations not covered by regular processes.

Integrated Financial Reporting

Take the Vietnam market, for example, where standalone accounting software can’t merge data from different retail operations into one central accounting module. It is not built for integration.

But an ERP can turn every process into financial entries that feed into your financial statements and management reports.

You can also set up your ERP and safe cost by utilizing ERP’s modularity:

- Scalability: Start with essential ERP modules and gradually expand. For instance, begin with financials (accounting, budgeting) and add other modules (CRM, e-commerce) as your business grows. It’s as if you are installing one software. In the case of Odoo management software, trying out one software with no customization would cost nothing, so it won’t hurt to try it before fully immersing your foot into the ERP world.

- Cost Efficiency: The modular model lets you avoid unnecessary expenses. No need to invest in features you won’t use immediately. For instance, install the Accounting module in Odoo and consider it as a free trial or free accounting software. No payment for a single-module installation and usage. As your business evolves, you can selectively activate relevant modules.

Focus on Your Business Needs: A Case Study

It's important to choose an ERP system that can be customized to your specific needs. While some ERP solutions, like Odoo, offer separate accounting modules, using a unified ERP approach with a strong core accounting component is often the most efficient and reliable option for most businesses.

3Sach Food, a growing Vietnamese grocery retailer, demonstrates how the right tools, like an ERP, can address specific accounting challenges in retail.

The initial eCommerce platform of the growing retail company fell short of customer expectations: Slow order processing, inefficient cart management, and lack of real-time inventory updates frustrated customers. The system took quite a long time to process orders, and it wasn’t very efficient.

Here’s the ERP magic: Portcities implemented Odoo’s integrated modules, which improved 3Sach Food’s POS performance, accounting processes and streamlined inventory management. Ultimately, it enhanced the online shopping experience, which led to more sales.

So, is Standalone or ERP-Based Accounting Software the Best for Retailers?

For retailers seeking a modern POS and omnichannel strategy, the choice between standalone software and an ERP system is crucial.

Standalone systems may offer initial simplicity and lower costs, but they lack the integration and scalability necessary for a growing business. As your operations expand, the limitations of standalone software become apparent, necessitating a costly and complex migration to a more robust system.

ERP systems, while seemingly more costly upfront, provide a comprehensive solution that grows with your business. They integrate financial management with supply chain operations, offering real-time insights and streamlined processes. This integration is vital for retailers who need a unified view of their business to make informed decisions.

Choosing an ERP system from the start eliminates the need for future data migration, saving time and reducing the risk of data loss. It’s an investment in your business’s efficiency and financial health.

Retailers, as you navigate the complexities of selecting the right accounting software, consider the long-term benefits and scalability of an ERP system. It’s not just about managing finances; it’s about empowering your business to thrive in a competitive market.

Let the facts guide you to a decision that aligns with your ambitions and provides the foundation for sustained growth and success.

Contact Portcities for a consultation, and together, we’ll create a masterpiece—a financial feast that satisfies your hunger for growth.